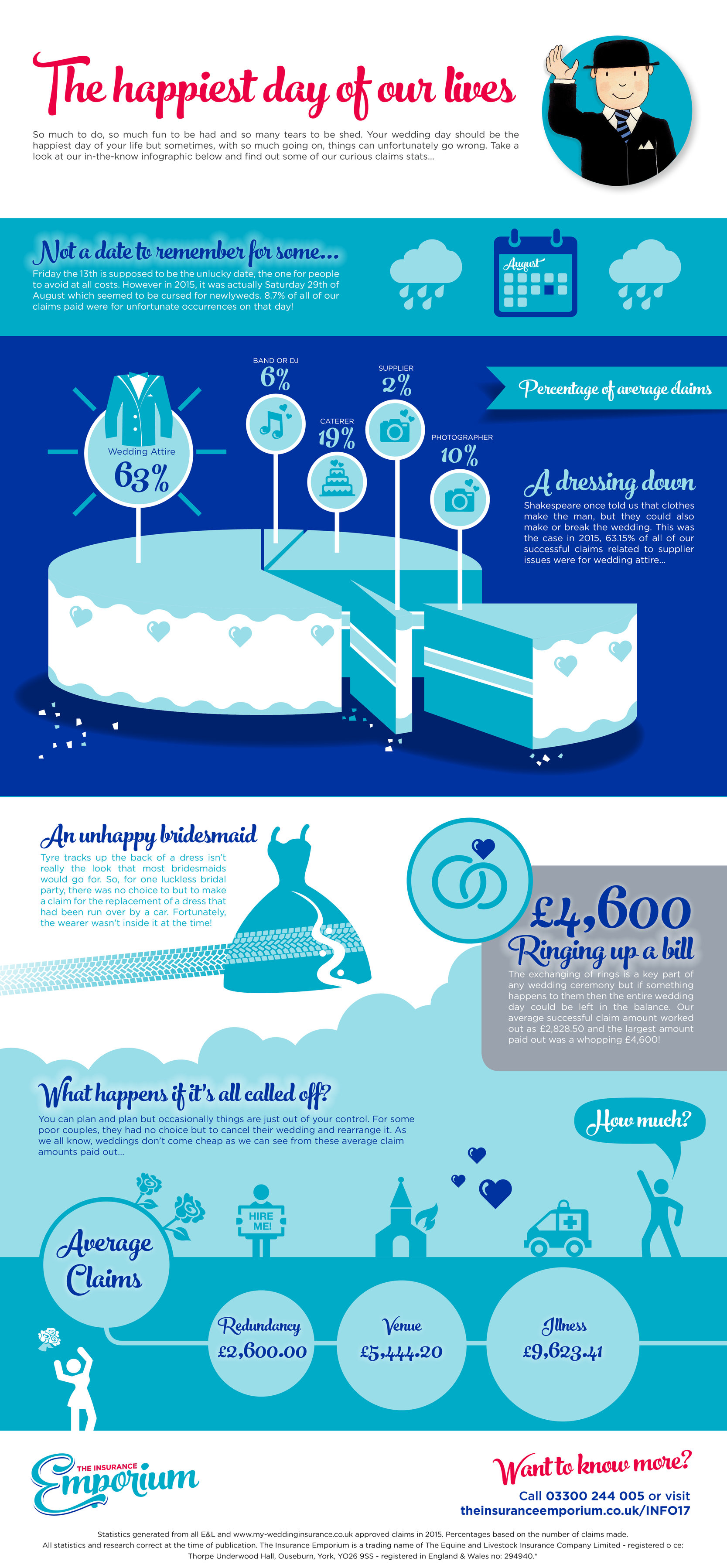

So much to do, so much fun to be had and so many tears to be shed. Your wedding day should be the happiest day of your life but sometimes, with so much going on, things can unfortunately go wrong. That’s why taking out Wedding Insurance could save you a whole load of heartache should your big day be compromised. Take a look at our in-the-know infographic and find out some of our curious claims stats…

A Date to Remember…Or not!

The unlucky date is supposedly Friday the 13th, the one many people try to avoid at all costs. But in 2015, Saturday 29th of August was actually the date which seemed to be cursed for those tying the knot. In total, 8.7% of all of our claims paid were for unfortunate occurrences on that day. More fuss on the 29th of August!

A Dressing Down

Clothes make the man, Shakespeare once told us. But on your special day, clothes can genuinely make or break the wedding. This was certainly the case in 2015! 63.15% of all of our successful claims related to supplier issues were for wedding attire.

Ringing Up A Bill

If something happens to the rings, then the entire wedding day could be left in the balance. After all, the exchanging of rings is a vital part of any wedding ceremony! Our average successful claim amount proved to be £2,828.50. But that figure is dwarfed by the largest amount we paid out, which was a whopping £4,600!

What Happens If It’s All Called Off?

You can plan everything meticulously. You can dot every I and cross every T, but some situations are just out of your control. For some poor couples, they had no option but to cancel their wedding and rearrange it. Weddings don’t come cheap, as most of us will be aware, and we can see this from the average amount paid out for three cancellation causes… Redundancy and venues issues were both £5,444.20, while illness came to £9,623.41!

An Unhappy Bridesmaid

When you think about bridesmaids, tyre tracks up the back of their dress isn’t really the look that many go for. Spare a thought then for the luckless bridal party who had no choice but to make a claim for the replacement of a dress which had a car drive over it. Thankfully, the wearer didn’t have it on at the time!

All content provided on this blog is for informational purposes only. We make no representations as to the accuracy or completeness of any information on this site or found by following any link on this site. We will not be liable for any errors or omissions in this information nor for the availability of this information. We will not be liable for any loss, injury or damage arising from the display or use of this information. This policy is subject to change at any time.