According to research by Statista in 2020 alone, UK manufacturers sold a staggering £127.8 million worth of golf clubs and equipment! With golf club theft in the UK estimated at £10 million each year by American Golf, golfers risk their expensive equipment being taken by opportunists.

Not forgetting the risks down at the club. Each time you play you enter a ground where multiple projectiles are repeatedly cannoned in all directions with great force! People, cars and houses all nearby are susceptible to getting hit – with zero protective clothing in sight. No matter which way you look at it, golf isn’t without its risks. When you can be covered by The Insurance Emporium from £1.68 per lunar month, it begs the question, why would you go without?

PERSONAL ACCIDENT

You may think you’ve got the reactions of a cat, but when you have a golf ball hurtling in your direction, it’s an entirely different matter. Many specialist golf insurance providers will cover you for personal accidents whilst playing on the course, unlike standard household insurance policies.

PUBLIC LIABILITY

You might not be the one getting struck by the ball, you could well be the person who sent it on its journey! Whilst you’re perfecting your shot down the fairway you never know who you may hit. The damage that a golf ball could cause shouldn’t be underestimated, the person at the other end could end up in a bad way, and they may wish to pursue a claim with their solicitor. Some golf clubs offer insurance which often includes a basic package simply covering golfers for public liability. But our specialist golf insurance, includes public liability up to £1.25 million as standard, amongst many additional bespoke golf benefits.

THEFT

Thieves can strike at any time and there may not be much that we can do about it. Whether it’s theft from your home, car or on the course itself, your expensive golf equipment could be very tempting for a potential thief. That cheeky upgraded driver here and new putter there… When was the last time you sat and worked out how much you’ve spent on your equipment? Does it match up to the cover in your household contents or car insurance? Having a specialist insurance policy could offer vital protection should the worst happen*. It’s worth remembering if your car is stolen or broken into, and your beloved golfing equipment is now gone, car insurance policies may not cover the full cost of replacing them.

ARE YOU COVERED BY YOUR HOUSEHOLD INSURANCE?

Cover levels are based on a lunar monthly Wentworth policy where the premiums are paid monthly. *Subject to security requirements. Terms and conditions apply.

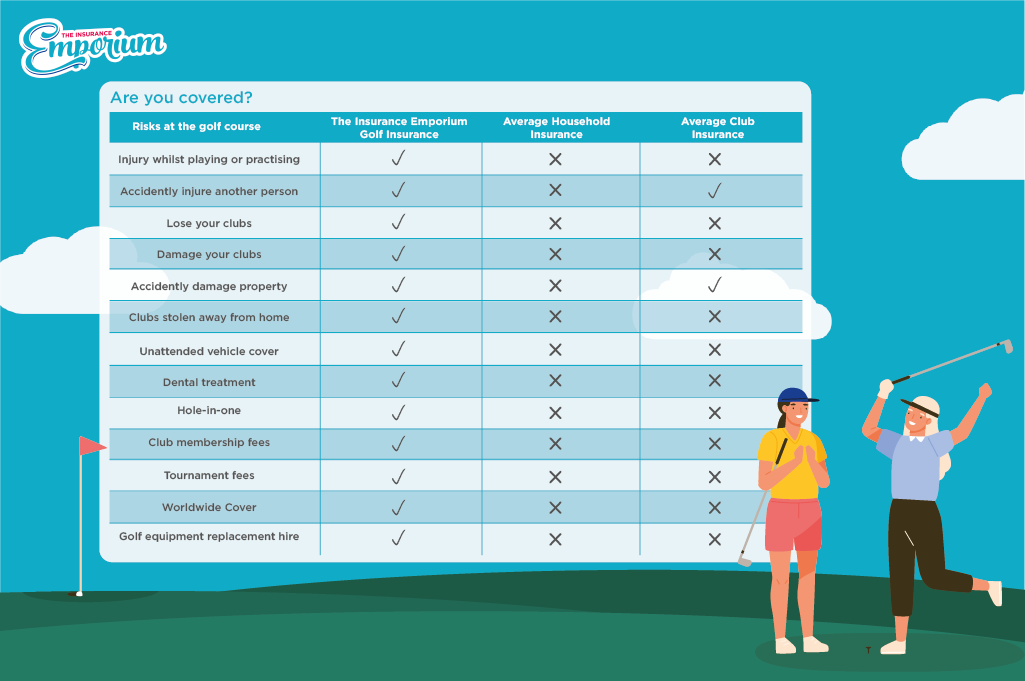

It’s a common misconception amongst golfers that standard household insurance will provide sufficient cover whilst on the course and away from home. Unfortunately, this is not always the case unless you have an extension of cover to your policy. You may wish to contact your household insurance provider. As you have learnt, specialist golf insurance may be of benefit to you. Why not grab yours today! At The Insurance Emporium our golf cover offers a range of 3 policy types to suit your individual golfing needs, with a range of optional benefits you can add. We provide cover for theft, loss, and damage of golf equipment; personal accident; public liability; unattended vehicle; dental treatment; personal belongings; club membership fees and tournament fees covered if you’re unwell and can no longer play.

We also even include hole-in-one cover, so you can truly celebrate this amazing achievement and not have to worry about the cost of the bar bill! For those of you who enjoy a game a little further afield, we offer Europe or Worldwide as standard. With cover starting from £1.68 per lunar month, it seems a no-brainer for peace of mind when heading onto the course. Grab your quote today!

All content provided on this blog is for informational purposes only. We make no representations as to the accuracy or completeness of any information on this site or found by following any link on this site. We will not be liable for any errors or omissions in this information nor for the availability of this information. We will not be liable for any loss, injury, or damage arising from the display or use of this information. This policy is subject to change at any time.